EU payments regulation:

Strong Customer Authentication (SCA)

Brand-new requirements bring new complexity. Beginning September 14, 2019, PSD2 regulation presented Strong Customer Authentication (SCA) requirements for lots of online payments made by European customers, to help in reducing scams. To guarantee online payments would not be declined, companies need to develop an extra layer of authentication into online card payments, unless transaction-specific exemptions apply.

What web businesses require to learn about the brand-new European policy

On September 14 2019, a new requirement for authenticating online payments just launched in Europe as part of the second Payment Services Directive (PSD2). In this post, we'll take a more detailed look at these brand-new requirements called Strong Client Authentication (SCA) and the kinds of payments they impact. Also, we'll cover the exemptions that can be used for low-risk transactions to provide a smooth checkout experience.

The effect of SCA on your company can differ depending upon the kind of purchase, whether you charge a customer throughout or after checkout, and even which bank your consumer utilises.

ASK US ANYTHING WORDPRESS RELATED: We can offer you confidently, SEVERAL OPTIONS to choose which one suits your needs better.

What is Strong Customer Authentication?

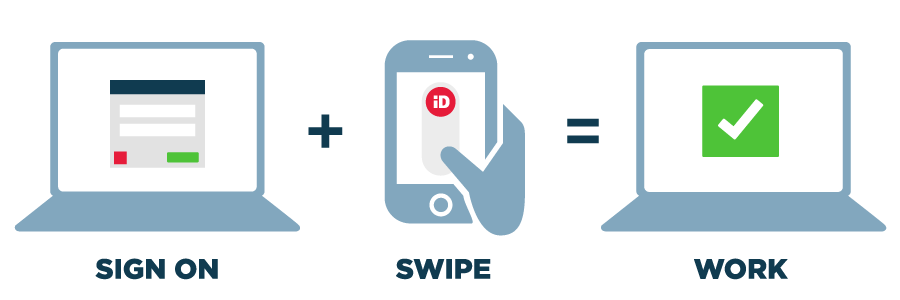

Strong Customer Authentication (SCA) is a brand-new European regulatory requirement to lower fraud and make online payments safer. To accept payments and satisfy SCA requirements, you need to develop extra authentication into your checkout flow. SCA requires authentication to utilise at least two of the following three components.

SOMETHING THE CLIENT KNOWS: password or PIN

SOMETHING THE CLIENT HAS: phone or hardware token

SOMETHING THE CLIENT IS: fingerprint or face recognition

Banks will require to start decreasing payments that require SCA and do not satisfy these requirements. Although we expect phased and fragmented enforcement of SCA across nations, we anticipate the very first banks to begin decreasing payments without two-factor authentication on September 14 2019. (On 4 September 2019, the Swedish regulator acknowledged the new guidance by the European Banking Authority. However, they expect to enforce SCA for online payments with Swedish cards starting 14 September 2019.)

When is Strong Customer Authentication required?

SCA applies to "customer-initiated" online payments within Europe. As an outcome, most card payments and all bank transfers require SCA. Recurring direct debits, on the other hand, are considered "merchant-initiated" and don't need strong authentication. Except for contactless payments, in-person card payments are likewise not affected by the brand-new policy.

For online card payments, these requirements apply to deals where both business and the cardholder's bank lie in the European Economic Area (EEA). We anticipate SCA guideline acceptance even in the UK, despite the outcome of Brexit.

We can offer you confidently, SEVERAL OPTIONS to choose which one suits your needs better.

Exemptions to Strong Customer Authentication.

Under this brand-new policy, particular types of low-risk payments might be exempted from Strong Client Authentication. Payment suppliers will be able to request these exemptions when processing the payment. The cardholder's bank will then get the demand, examine the risk level of the deal, and eventually decide whether to authorise the exemption or whether authentication is still essential.

Building authentication into your checkout circulation presents a new action that can add friction and boost customer drop-off. Utilising exemptions for low-risk payments can decrease the number of times you will need to verify a client and reduce friction.

The most appropriate exemptions for internet organisations are:

-- Low-risk deals.

A payment provider is permitted to do a real-time danger analysis to determine whether to use SCA to a deal. This process might only be possible if the payment company's or bank's general fraud rates for card payments do not surpass the following thresholds:

0.13% to exempt transactions below EUR100.

0.06% to exempt deals below EUR250.

0.01% to exempt sales below EUR500.

These limits will convert into regional currency equivalent quantities, where appropriate.

In cases, where the payment company's fraud rate is below the threshold, but the cardholder's bank is above it, we expect the bank to decrease the exemption and require authentication.

-- Payments listed below EUR30.

Another exemption for payments is a low amount. Deals below EUR30 are about "low worth" and "might be exempted" from SCA. Banks, however, need to ask for authentication if the exemption has been used five times since cardholder's last valid authentication, or if the amount of previously excused payments surpasses EUR100. The cardholder's bank requires to track the number of times this exemption has been used and choose whether authentication is essential.

Due to the stringent limitations of this exemption, we anticipate the low-risk deal exemption to be more pertinent for most payments. We do, nevertheless, assistance this exemption for our users.

-- Fixed-amount subscriptions.

This exemption can apply when the customer makes a series of repeating payments for the same amount, to the exact equal company. SCA requires for the customer's first payment-- subsequent charges nevertheless might be exempted from SCA. We expect this exemption to be extremely beneficial for subscription businesses and broadly supported by European credit and debit cards.

It’s time to see THE BIG PICTURE!